MoneyGram is now available on Morpara!

Yurt dışından para almak hiç bu kadar kolay olmamıştı. Moneygram ve Morpara iş birliği sayesinden referans numarası ile para almayı keşfet!

Üstelik ismine gelen transferlerde Moneygram komisyon ücreti de yok!

Fast, Easy, and Reliable

MoneyGram is a globally recognized international money transfer service. Thanks to the option of receiving money using a reference number, it allows you to collect funds sent to your name from abroad without needing an account at a financial institution.

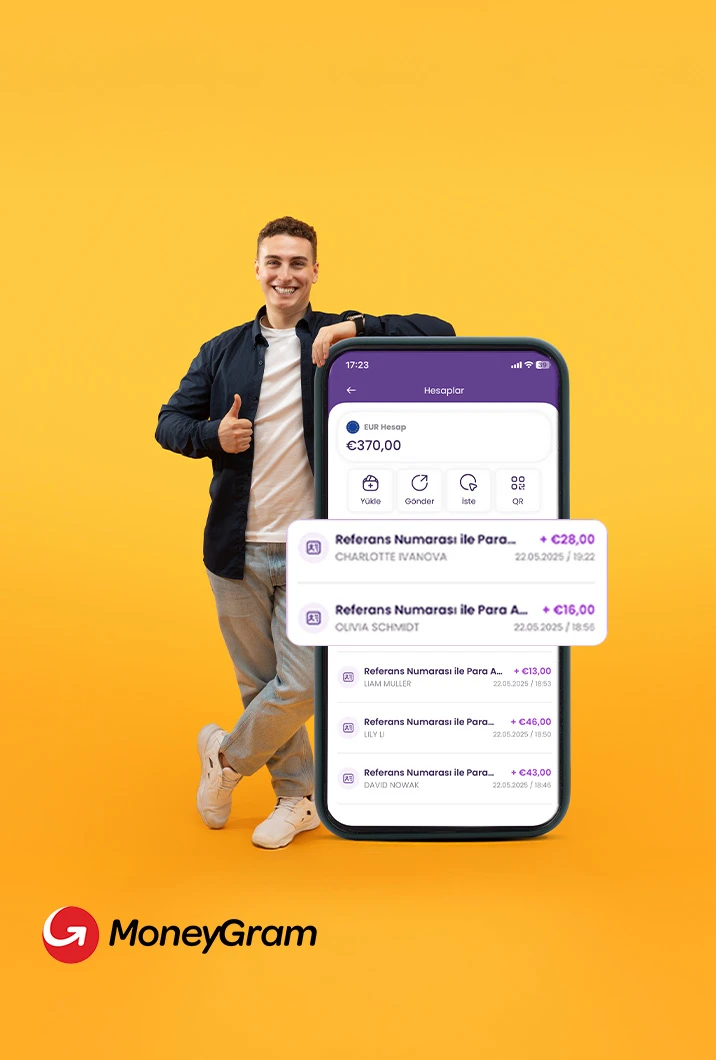

Get Paid with Just a Reference Number!

The new answer to “How do I receive money via MoneyGram?” is Morpara!

As a Morpara user, you can receive international money transfers in seconds. All you need to do is enter the reference number provided by the sender into our mobile app—quick, easy, and secure!

One app. Over 200 countries.

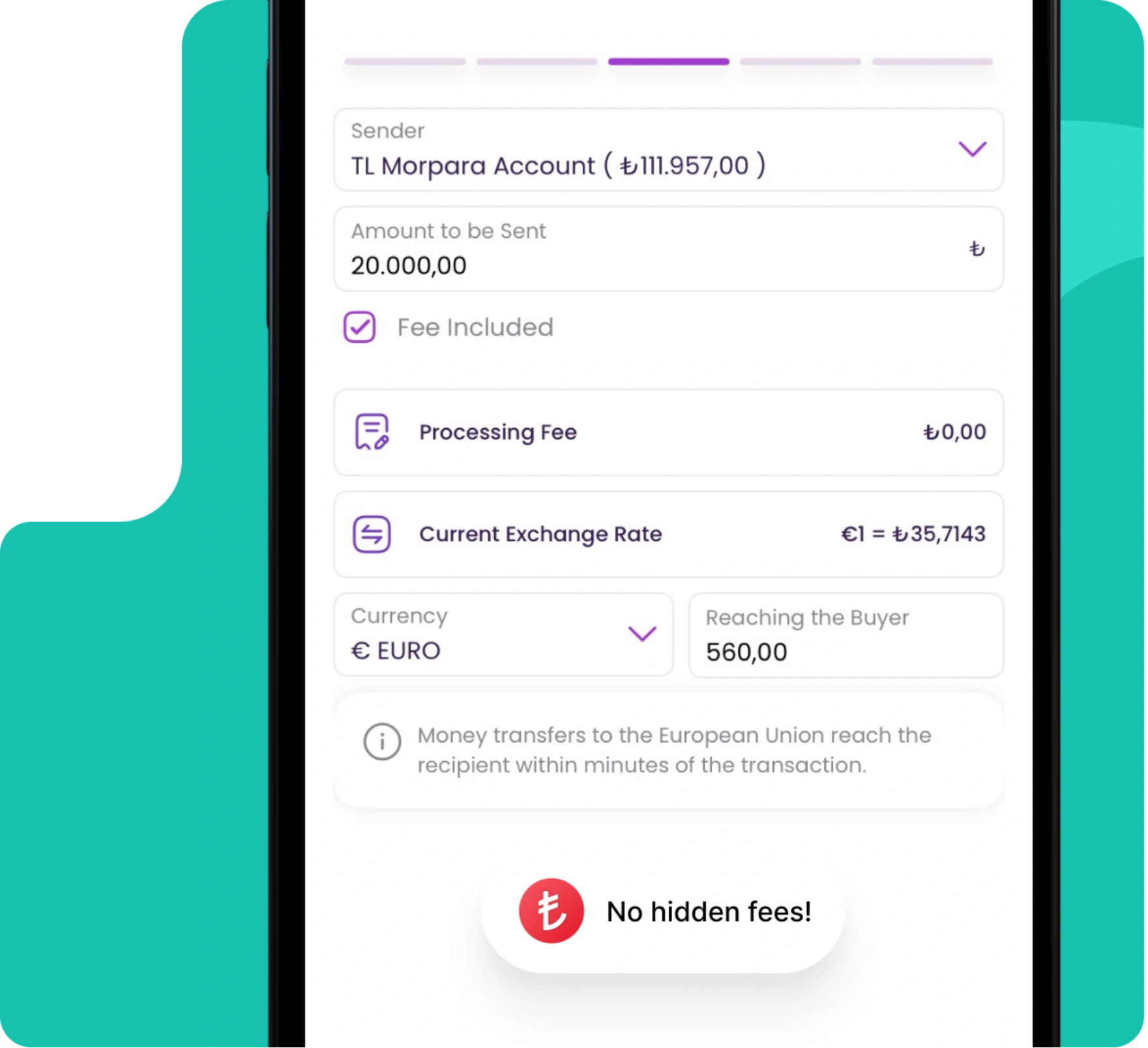

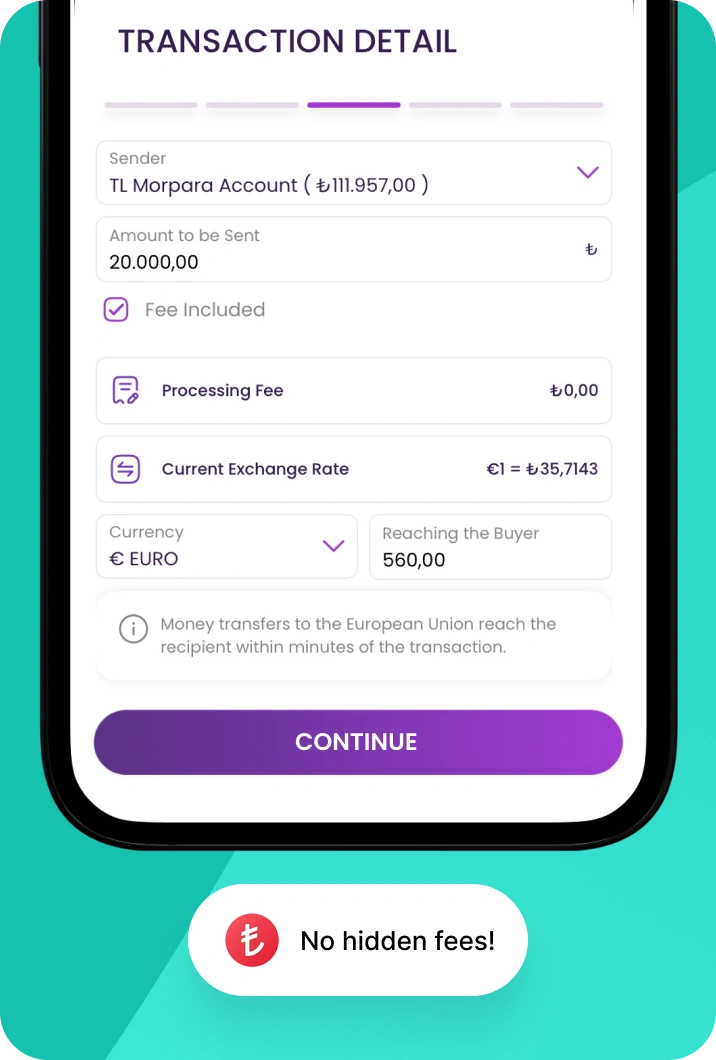

Transfer money abroad with our transparent fee policy

Commissions on money transfers abroad are very attractive with Morpara. Calculate the money transfer fee transparently from our calculation tool and make your transfer from the Morpara application.

Buy in foreign currency, convert anytime you like.

When receiving money via MoneyGram, we open a foreign currency account for you. You can keep your money in the account for up to 30 days and convert it instantly anytime you like.

Frequently Asked Questions

A Virtual POS (Virtual Point of Sale) is a digital POS solution that allows businesses to accept online payments through credit and debit cards. Acting as the online equivalent of a traditional POS terminal, a Virtual POS is essential for modern businesses looking to offer a seamless e-commerce payment gateway experience. It is commonly used by e-commerce websites, mobile apps, and online service providers to securely process transactions and enhance customer convenience.

MorPOS is an innovative virtual POS solution that enables businesses to accept fast, secure, and flexible online payments. Designed for e-commerce websites, mobile applications, and online service platforms, MorPOS offers easy integration, advanced security infrastructure, and flexible payment options to help streamline digital sales processes. It provides a reliable and user-friendly online payment system that meets the needs of modern businesses.

The MorPOS API is compatible with all kinds of platforms. Whether it's e-commerce platforms, mobile applications, or custom software, MorPOS enables easy integration.

Yes, with MorPos, you can easily accept payments from international customers. International customers just need to enter their card details on the payment screen and click "Pay" to complete the transaction securely.

In addition to Turkish Lira (TRY), MorPOS allows you to accept payments in US Dollars (USD) and Euros (EUR). With multi-currency support, you can easily accept international payments.

With MorPOS, commission fees are automatically deducted at the time of the transaction and the net amount is transferred to the merchant's account.

Real-Time Collection: Commission fees are collected instantly for every transaction, and payment is made to the merchant immediately after the transaction.

Reporting & Reconciliation: Detailed reports are provided on a daily, weekly, and monthly basis, making transaction tracking and reconciliation easy.

MorPOS offers flexible payment options for merchants. Depending on the business model, payment periods are as follows:

Daily Payments: Transactions made on the previous day are transferred to the merchant's account on the next day.

Weekly Payments: Payments are made on a weekly basis.

Term Payments (T+X Model): Based on the agreement with banks or payment providers, payments can be made in 7, 14, 30 days periods according to the set term.

MorPOS prioritizes the security of both users and businesses. It supports advanced security protocols such as PCI DSS compliance and 3D Secure. With these certifications, transactions are processed in a secure and encrypted environment.

MorPOS Security Features:

PCI DSS Compliant: PCI DSS (Payment Card Industry Data Security Standard) certified to securely process credit card information.

3D Secure: The 3D Secure protocol adds an extra layer of authentication for secure transactions.

SSL Encryption: SSL encryption ensures that all data is transmitted securely.

MorPOS is a highly secure payment solution for e-commerce, mobile apps, and online service providers.

MorPOS transactions are managed according to the policies set by merchants and the rules of the bank/payment service provider.

Cancellation Process: If the payment is still in pre-authorization, the cancellation is processed immediately, and the amount is not charged to the customer’s card. If the payment is completed, the cancellation is replaced by the refund process.

Refund Process:

Once the transaction is canceled or the refund request is approved, the amount may take 1-7 business days to be refunded to the card, depending on the payment method and the bank.

Important Notes:

Cancellation and refund processes are carried out in accordance with the merchant’s refund policy. Fraud detected transactions or payments deemed suspicious by banks may require additional verification.

Yes, with MorPos, you can accept payments from all bank cards including Visa, MasterCard, and TROY. You can process secure payments with both local and international bank cards.

Currently, installment payments are not available through MorPos. However, this feature is planned for future implementation. MorPos currently supports single payment options for fast and secure transactions.

MorPos implements high-level security measures before, during, and after transactions to prevent fraud and fraudulence. Here are the fraud prevention methods:

3D Secure (3DS) Technology:

During payment, the customer receives an authentication code via SMS, email, or mobile app from the bank.

This extra step is critical for preventing unauthorized transactions.

Fraud Prevention Software and AI-Powered Systems:

AI and machine learning-powered systems analyze transactions in real time and detect suspicious activities.

The system looks for anomalies related to historical data and user behaviors, automatically blocking suspicious transactions.

MorPos offers the most secure payment infrastructure with fraud detection methods before, during, and after the transaction. This ensures your business and customers are always protected.

Once the necessary conditions are met, the MorPOS integration will be completed within 2 hours. Start accepting online payments quickly and easily with seamless virtual POS setup.

For virtual POS application, you can fill out the contact form on our website, write to our e-mail address destek@morpara.com or share your request with our Call Center at 0850 290 3410.

Fill out the application form and our professional team will contact you as soon as possible. Start accepting secure online payments with MorPOS today.

Documents Required for the Application Process:

To start accepting online payments securely with MorPOS, please prepare the following documents during the application process:

Signature Circular: A document showing the authorized signatory of the company.

Commercial Registration Certificate: A document proving the official registration of the company.

Identity Information: A copy of the company representative's ID card or passport.

Business Model Information: Information about your field of activity, payment flow, and sales model.

Additional Documents: Our team may request additional documents after evaluation. You will be contacted for these documents.

Benefits of Accepting Payments with MorPOS:

💳 Wide Card Support: Accept payments from all local card programs in Turkey (Bonus, Maximum, World, TROY) and international cards (Visa, MasterCard, American Express).

🔗 Easy Integration: Quickly integrate with your website, mobile app, or e-commerce platform.

⚡ Flexible Payment Options: Offer your customers flexibility with one-time payments and installment options.

🔒 Advanced Security: Secure transactions with PCI DSS compliance, 3D Secure, fraud prevention systems, and SSL encryption.

🚀 Fast Payment Collection: Flexible payment periods such as daily, weekly, or based on agreement for faster transactions.

💱 Multi-Currency Support: Accept payments in Turkish Lira and foreign currencies, and process transactions with foreign currency cards.

📊 Comprehensive Reporting and Analytics: Manage your financial processes easily with detailed transaction reports.

Multi-currency POS is a POS device option that allows businesses to receive card payments in foreign currencies.

Your Morpara International Account is valid for institutions, individuals, and banks across the entire European Payments Area (SEPA) that can send transfers to GB IBANs.

Morpara International Account is linked to your Morpara TL account. Our international money transfer system provides you with a personal EURO IBAN that allows you to receive money from abroad.

When funds are sent to your EURO IBAN, they are instantly converted to Turkish Lira (TRY) at a competitive exchange rate and deposited into your Morpara account.

In short, the Morpara International Account enables you to receive Euro-denominated international transfers directly into your TL account.

You can receive money from the Single Euro Payments Area (SEPA) using your Morpara International Account.

Our Other Services

Become a Morpara member and start sending money now

With Morpara, you can open an account quickly and securely, create your own electronic account in just a few steps and request your card for free. Download our application by scanning the QR code and join us!